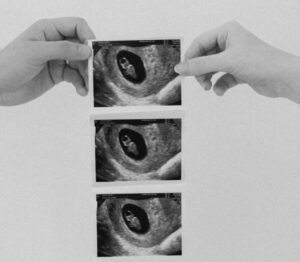

When You Find Out You’re Going to Be A Dad

For men considering becoming a father, here’s the story of how I embarked on the incredible journey of dude to dad.

DISCLOSURE: I’m just a humble blogger with a knack for numbers and a heart for God. While I believe that Biblical principles are great guides for our financial decisions, I cannot guarantee that this advice will turn water into wine or multiply your loaves and fishes.

The opinions expressed in this blog are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. It is only intended to provide education about Biblical applications and the financial principles contained within. Therefore, please use your own judgment, do your own research, and consult a qualified professional before making any financial moves.

Wealth gained hastily will dwindle, but whoever gathers little by little will increase it.

– Proverbs 13:11

In today’s post, we’ll be tackling the financial question I get most often from friends, many of whom are early career professionals like me.

That question usually sounds something like this:

“I’m starting to make money and I want to be faithful to God with his money while investing and saving wisely at the same time. What practically should I be doing with my money?”

While I am, once again, not a financial advisor (don’t sue me, please), and every individual’s situation is different, I do believe there are certain approaches to this question that generally yield good results.

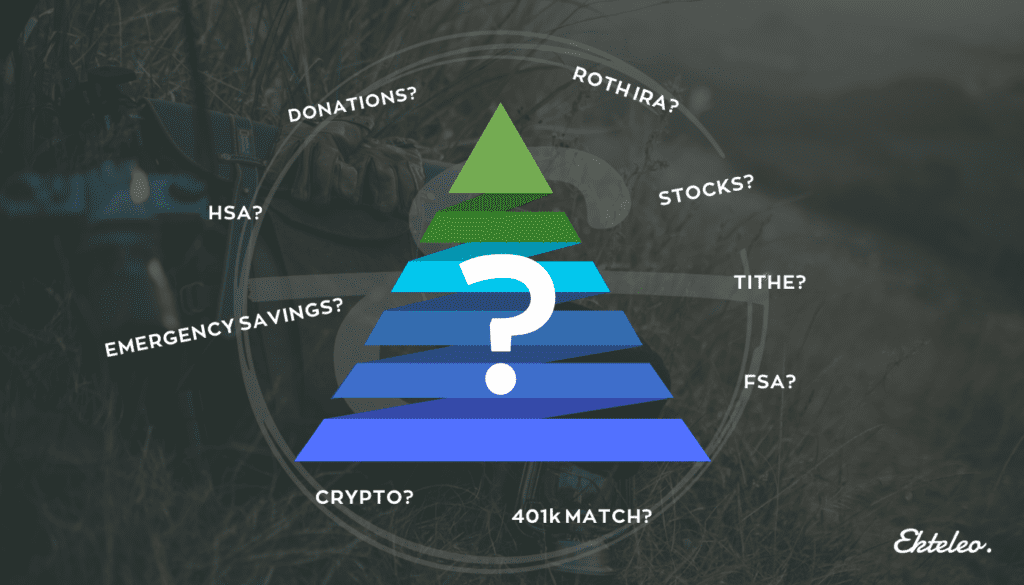

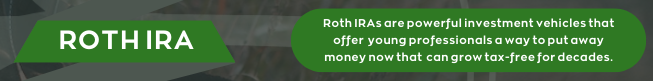

In this post, I’ll be sharing the approach which my wife and I personally use so that we can remain consistent in our giving and prepare for our future and whatever it may hold. To visualize the approach: we’ll refer to the lovely visual below throughout this post.

You may notice a couple of pretty important things missing when it comes to holistically approaching your finances from a Biblical perspective.

“But Ryan, what about debt, bills, and all those other 100% necessary living expenses?”

I am ignoring these pretty important money factors in this post (if only it were that easy to ignore debt and bills in real life!) because I’m assuming that if you are asking about what to do with your money, you have already covered these non-negotiables. In other words, this is not a post on budgeting. We’ll have plenty of those down the road, don’t worry!

However, one quick aside to share a personal belief: If you do not plan to tithe, save, and invest with the first dollars in your bank account, it is highly unlikely that you will have any money “left over” for such activities after paying for all other expenses and purchases throughout the month.

So although this is not a comprehensive post on budgeting, it does assume that somewhere in your budget, you have prioritized tithing, saving, and investing as non-negotiables to be taken out of your paycheck before anything else. This may not be 100% true or realistic for every person, but it’s all about those baby steps, baby!

One more question you may be wondering, because I know that I did as I was writing this post:

“If this is a Biblical approach to money, shouldn’t the goal be to just give as much as possible away?”

Frankly, maybe.

It is possible at any point in your financial journey that God will call you to generosity above and beyond your normal tithe.

….And you’ll be all the better for it.

The reason you won’t see a specific step of the pyramid called out for “additional generosity and giving” is that I believe it would be a mistake to assume that giving more to Kingdom causes should happen at the same time and in the same way for everyone.

Like the rich young ruler in Matthew 19, God may call you to sell all that you own before you even hit step two in the pyramid, but he also might have great Kingdom plans in future for the wealth you are building here and now.

Listen well to his voice in all things related to your (his) money, and he will make it clear what you should be doing with it.

With the fine print out of the way, let’s get into the strategy itself and start talking about the specific actions I believe most young professionals should be taking when it comes to the first few dollars that hit their bank accounts every month.

Tithing is a familiar concept to many who have grown up in church and is often associated with proportionally giving away 10% of what someone earns.

If the first thing you do when you earn money isn’t give it back to God, you will never be free from money’s hold on your life.

Giving our “first fruits” back to God through a tithe reminds us that he gave us everything we have to steward for his glory. Pointing your finances toward his mission first and foremost will set the standard for every money move you take throughout your life.

10% as the standard proportion for tithing comes from several examples in the old testament (Genesis 14:20, Leviticus 27:30-33) where followers of God gave the first 10% (whether it was their first of ten cows or first of ten coins) to God as an offering.

You may be thinking – Jesus came to fulfill the law, so we shouldn’t have to follow Old Testament practices anymore, right? Is 10% still a relevant proportion for us today?

It’s true that 10% is not a magic number, and it’s true that Jesus fulfilled the law and made it possible to be right with God through grace instead of through Mosaic law.

This is why Paul (in the New Testament) never advocates for a specific amount of tithe or giving. He advocates instead for the preparation of your heart to be a “cheerful giver”.

However, an important caveat here – if you’re thinking this freedom means we should give less than 10%, or not at all: Every example of faithful giving in the New Testament describes giving far above and beyond 10% in obedience to God.

With that said, I still like 10% as a goal for those beginning to thoughtfully and faithfully plan how they will manage their finances and submit all of what they have to God’s authority.

It is a significant enough amount to remind us who our money really belongs to while not representing such a large percentage that it may seem initially unachievable for those in tight financial situations.

Regardless of the proportion that God ultimately leads you to give, the tithe is an important foundation for any Christian financial planning strategy and should be prayerfully considered and faithfully given.

That’s right – before you even think about putting your money into an investment of some kind, you need an emergency savings fund.

In Genesis 41, Joseph is led by God to prepare the people of Egypt for seven years of famine by storing up grain during the preceding seven years of plentiful harvests. Here we find an excellent template for God’s expectations and recommendations for us during years of plenty – prepare for the years of famine ahead.

The truth is, no one really knows what their famine will be until it hits. Car crash. Unexpected health expense. Job loss. Whatever that unplanned (and usually very expensive) event may be for you, it becomes that much harder to handle if you don’t have any emergency savings to draw upon.

What the ideal amount of emergency savings may need to be is going to be different depending on your life stage and ability to rely on other sources of income or savings if things go south.

6 months of living expenses is general advice for a very solid emergency account balance, but for young professionals without dependents, 1-3 months may be a more tangible goal to reach before attempting to fund other savings/investment types.

One way to make this easier: open up a separate high-yield savings account that will automatically withdraw your planned savings amount from your normal checking account on the same day each month, preferably the same day that your paycheck arrives.

Also, look for savings accounts with limits on the number of withdrawals you are allowed to take each month. This will automate your saving strategy and discourage you from dipping into your savings account except when needed for true emergencies.

For the extra tactical budgeters among us, it may also be helpful to fund smaller savings accounts for unplanned expenses that aren’t quite “emergencies” but would still have a negative impact on the monthly budget.

A great example would be having to unexpectedly spend $1000 on new tires for your car just before gift-buying at Christmastime. Instead of footing the bill all at once for both of these large expenses, I recommend opening multiple other named savings accounts to fund little by little throughout the year in preparation for the inevitable big ticket items.

Good examples would be separate savings buckets for car expenses, gifts, and most importantly, health/medical if you aren’t able to utilize the next tier on our list due to your employer’s insurance options.

The fact that I’m excited to write this section might be a sign that I’m getting old, but yes, the 401k match (or its nonprofit/government cousin, the 403b) is the first true “investment” that I believe most people should consider when they’re ready.

Employer-sponsored retirement accounts like 401ks and 403bs:

Lower your taxable income (if you opt for a tax-deferred plan and not a Roth) which means huge tax benefits for you and the fam

Automate your saving so you don’t have to think about putting away money yourself (huge)

Grow tax-free across your lifetime, which means compound interest will supercharge your investments over time, especially if you start early

These types of accounts are most valuable if your employer is offering some kind of match for the money you put into your 401k/403b yourself. Many employers do, and doing some research into your benefits package to find out what’s offered in this area will be more than worth your while.

If you have a match included in your benefits package, you’ll probably see something like “50% match, up to 6%” in your contract, which is a slightly confusing way of saying that your employer will put in $0.50 for every $1 you put in for up to 6% of your annual salary.

For example, let’s say you make $50,000 a year before taxes and you want to get your full employer match with the terms above.

6% of $50k is $3000. If you were to take full advantage of your employer’s match, you would opt to put $3000 of your salary into your 401k account across the year, which translates to about $115 every paycheck, if you’re paid biweekly.

Your employer would match 50% of that contribution, which means they would put in an additional $1500 to bring your balance up to $4500 after one year.

Matching is a HUGE benefit, and your employer’s match is going to be far better than any investment you could consistently earn out on the open market.

I find it to be a common misconception to call your employer-match “free money” – the truth is that your employer includes the cost of matching your 401k / 403b in your compensation package.

Translation: If you don’t take advantage of your employer’s 401k / 403b match, it’s like giving money that your employer has earmarked for you back to them.

Your 401k match is not just free money left on the table – it’s literally your money!

So go get your money!

After reaching your matching amount, the 401k / 403b may or may not make sense as a way for you to continue investing. If you want an easy way to “set and forget” your investing, having your employer continue to take out your contributions for you past the initial matching amount might be a great option.

Personally, we prefer maxing out our employer matches and then moving on to other types of savings/investment options that allow for greater flexibility with investment options and easier access to funds.

Just like 401ks, many employers may offer to pull money out of your paycheck pre-tax and place it into a Health Savings Account (HSA) for you.

HSAs don’t get the respect or attention they deserve, but these sneaky awesome accounts are incredibly powerful tax-advantaged ways to save up for planned and unplanned medical expenses down the road AND grow your wealth tremendously at the same time.

They also carry with you for your lifetime, so an HSA opened and funded consistently in your 20s can compound and grow to pay the lion’s share of you and your family’s medical expenses down the road when you truly need it.

A common misnomer is that HSA funds can only be spent on doctor’s appointments, and only spent on yourself. In reality, the federal government considers Health to be a very expansive topic, and HSA funds can be used on a variety of health-related expenses such as over-the-counter medicine, dental treatments, and physical therapy, to name just a few from a long list published by the IRS each year.

HSAs are considered triple-tax advantaged, meaning that:

Any HSA contributions are made from your gross paycheck pre-tax.

Spending out of HSAs on qualified health purchases is always tax-free.

If you choose to invest your HSA funds, they will grow and compound tax-free in your account.

As with all tax-advantaged tools, the rules for utilizing your HSA funds may depend on your specific situation and benefits plan. Because of this, it is 1) always recommended that you consult a professional benefits advisor and/or tax consultant before opening an HSA and 2) that you save all invoices and receipts from HSA purchases during the year.

HOWEVER – don’t let this scare you from looking into one of the very best savings and life-planning options available to young adults. A well-funded HSA in your early years can grow exponentially and set your family up for life to be able to weather healthcare storms that may eventually come your way in the long term.

Note: I am less gung ho about the HSA’s cousin, the FSA since FSAs don’t carry with you from employer to employer and may not even carry over from one year to the next. However, FSAs can still be a great option to put away small chunks of money each paycheck if you have consistent medical expenses throughout the year.

Anyone who knows me well knows I have a hard time shutting up about Roth IRAs – There’s just so much to love!

As a quick summary of Roth IRAs:

These are after-tax retirement accounts, individually owned by you.

Roth investments grow tax-free, which means your contributions can earn compound interest for years to come and you won’t owe a dime in taxes as long as you wait until retirement age to withdraw them.

There is an annual income limit for whether you can or cannot Roth IRA contributions, so take advantage of the opportunity while you’re young if you expect to out-earn the income limits one day.

Did we mention tax-free compound interest?

As with all investments, the true power of the Roth IRA is harnessed with time. And if you start early, you’ll have decades of tax-free investment growth to enjoy once you hit retirement age.

You can also withdraw your contributions from your Roth at any time if you follow the right procedure – just be careful not to withdraw earnings without doing some research or speaking with a tax advisor, or you may trigger early withdrawal penalties.

Okay. You’ve made it this far, and you still have some money you’d like to put to use. You must have your stuff together!

It all comes down to personal preference, and some people would prefer to put all available funds into investments for the future.

Personally, we like to put aside a little money each month for short-term financial goals. This can be anything from saving up for vacations, a new car, or even a down payment.

Saving up for a near-term purpose and achieving that goal is a great way to reward yourself for having financial discipline that will also keep you motivated to continue saving and investing for the long term.

Set your goal, and work towards it week by week by lowering unnecessary expenses and increasing earnings where possible. Then when you hit your goal, celebrate!

Then set another one.

Outside of personal savings goals, we have also found great joy in setting money aside with the specific purpose of knowing we’ll give it away – even if we’re not completely sure who or what we’ll give it to until the Lord makes it known.

If the money is already accessible and not dedicated to a current need of your own, it’s very easy to be generous when you encounter a worthy cause. And don’t worry – it is always worth it, far more worth it than anything you might buy for yourself.

To come full circle to the very beginning of this post, being financially well-off can be a dangerous path for Christians to walk. It requires discipline, attentiveness, and most of all, complete trust in the Lord with your resources.

Jesus spoke about money more than any other subject because he knew something that is still true today – if you want to know where someone’s heart and passions lie, just follow the money.

If you live in North America and hold down a full-time job, congratulations – you are more than likely in the top 20% of earners in the world.

But Jesus warned this:

“Everyone to whom much was given, of him much will be required, and from him to whom they entrusted much, they will demand the more.” (Luke 12:48)

We have so much wealth and opportunity in this area of the world. The Bible calls us to steward that wealth wisely, and while money is the root of many kinds of evil, it can also be used to enact incredible amounts of good.

The approach outlined in this blog is not prescriptive – and may not work for everyone. You may find it advantageous to change the order, skip some steps, or even create your own “order of operations” for you and your family, based on your specific situation.

And I would strongly encourage you to do so!

Most of all, I pray that you would lean into the Lord’s calling for your money – never clutching it tightly and always being a place where you can give freely and use the blessings you have been given to bless others even more deeply.

Because by following the principles outlined in this article, you may set yourself and your family up for long-term financial success.

But more importantly, you will learn to practice discipline, long-term thinking, and generosity, all of which will serve you better than any amount of money ever could.

Most of all, you’ll approach your finances strategically so that you can ultimately spend less time thinking about them and learn to give freely of them to serve the Lord.

And that’s the whole point.

For men considering becoming a father, here’s the story of how I embarked on the incredible journey of dude to dad.

A lot has been said about the reasons why people shouldn’t get married young, but I’m here to explain why it might be one of

It’s easy to overcomplicate the topic of purpose when we live our lives with so much noise, but God’s will shows us how to be

… for which of you, desiring to build a tower, does not first sit down and count the cost, whether he has enough to complete it? Otherwise, when he has laid a foundation and is not able to finish, all who see it begin to mock him, saying, “This man began to build and was not able to finish.”

Luke 14:27-30 (ESV)

Copyright © 2025 All Rights Reserved